The real estate market in Dubai has become increasingly interesting for investors and expats in recent years. In this article, we therefore explain everything you need to consider when buying a property.

From the process and costs to legal aspects. We also share personal experiences and recommendations for established German brokers.

Dubai apartment for sale – TOP 5 aspects

Below are the 5 most important aspects to consider when buying a property.

Purpose

One of the most important aspects that a person needs to consider before buying a property in Dubai is whether they want to purchase the property for investment purposes or for personal use. The motive for identifying a personal property in Dubai is explained below:

Investment

The real estate market in the UAE is very popular and there are many advantages to buying a home in Dubai. These include high rental yields, high market capitalization and a transparent process for businesses. Most foreigners or expatriates hope to buy an affordable home in Dubai that will give them a high return on investment. A thorough assessment of the market can help in buying an apartment in Dubai at a good price.

If you are thinking of renting out your property in Dubai, you should focus on how much money you will earn. This will give you a better idea of whether the potential rental income will be sufficient to cover your repayments, mortgage and maintenance costs.

As a rule, investors can achieve a gross return of between 5% and 9%.

Personal use

Over the years, Dubai has developed into a huge real estate and business center. The city is now home to numerous expatriates who come from different parts of the world. Real estate in Dubai is often considered very expensive and unaffordable for many foreigners who work as laborers.

But that has now changed. People who are employed or have their own business in Dubai are now more inclined to buy their personal property rather than rent it out. As the government has lifted certain restrictions on property ownership, buying property in Dubai is no longer as complicated for foreigners.

If your personal motive for buying a property in Dubai is residential, then you should pay attention to whether the location is close to hospitals, supermarkets, restaurants and schools. Raising your family in a progressive and developed city like Dubai can be a very rewarding experience.

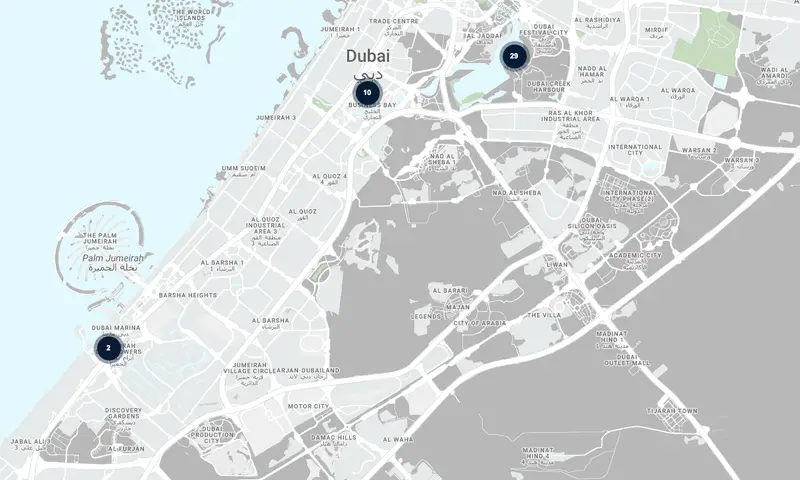

Location

One of the most important elements to consider before investing in real estate in Dubai is location. Individuals looking to invest in an apartment or luxury home in Dubai should research the best locations for future real estate investments. Some of the best locations in the city, such as Dubai Marina, have a range of facilities that allow for a high-end lifestyle.

Investors should therefore look for locations that could be advantageous for them. Searching for such properties can be time-consuming. However, Real Estate provides you with a list of the best properties in Dubai in ideal locations that can offer long-term returns to foreign buyers.

Condition

One of the most important aspects, which also differs from German standards, is the quality and condition of the property.

The construction quality in Dubai is only very good with the largest developers such as Emaar, Meeras or Damac. This is basically the first thing to look out for. The second aspect is whether the property is still under construction, first occupation or second-hand.

Buying off-plan apartments during construction has several advantages. The prices are considerably lower, but there is also the option of an interest-free payment plan. This makes it extremely interesting for investors. However, as delays can occur, this is usually not the best choice for owner-occupation.

For properties that have already been completed, you usually pay a little more. In return, you get a new apartment that is ready to move into. However, if you focus on new areas, you can expect prices to rise over the next few years. (e.g. Dubai Creek Harbour)

Second-hand properties usually achieve lower yields, but are still a good investment in terms of rental yields. If you focus on established areas such as Downtime, Business Bay or Marina, you will get a very safe investment. (provided the quality is still good, of course)

Here you will find all Apartments for sale in Dubai.

Additional costs

Buying a home in Dubai comes with certain costs. It is important that you get an overview of all the fees associated with buying a home in Dubai in advance. This is important in order to budget accordingly.

- NOC fees: These are usually between AED 500 and AED 5000 and can be paid directly to the real estate company or developer.

- Registration fees: Approximately 4% of the total purchase price of the property can be paid to the DLD.

- Real estate agent’s commission: This amounts to almost 2% of the purchase price of the property.

Apart from the potential costs, additional fees may also be incurred. These could be incurred by both the developer’s office and the DLD. You may also have to pay community/building fees to the developer.

Reputable broker

One of the most important aspects of buying an apartment in Dubai is an experienced and competent real estate agent. There are countless real estate agencies in Dubai itself, but you should also trust the biggest ones.

The broker should fulfill the following aspects:

- Clarification of all costs

- Professional & fast processing

- Ongoing support for further questions

- Local knowledge (as new projects are constantly emerging)

You are welcome to contact usbecause we work exclusively with professional brokers from Germany, Austria and Switzerland who have established themselves in Dubai and with whom we have been working successfully for years.

Procedure

A brief overview of the process of buying an apartment in Dubai. (In the case of a completed apartment)

- The buyer and the seller agree on the terms of the sale and the price of the property.

- Both the buyer and the seller sign a Memorandum of Understanding (MOU) before proceeding with the transfer of the property, which sets out the terms of the agreement. The MOU must be registered with the DLD. A 10% deposit is paid at this time.

- Both parties must apply for a No Objection Certificate (NOC) from the developer in order for the property to be transferred. A fee is charged for the issuance of the No Objection Certificate.

- The transfer of the property must be officially registered with the DLD and a transfer fee of 4% is payable at that time.

- Under the terms of the DLD, the buyer must make payment in the form of manager’s checks payable to the seller on the date of transfer of the property. If the buyer is paying by means of a mortgage, a representative of the bank must be present at the completion of the relevant paperwork and formalities.

- If the seller has taken out a mortgage on the property at the time of sale, the buyer is responsible for settling the mortgage before applying for the NOC.

- Once all the above formalities have been completed, a new title deed is issued in the buyer’s name and the property is officially transferred from the seller to the buyer.

Required documents

Documents required for a private buyer:

- Passport of the buyer

- Legal ID card

- Proof of address

- Contact details

Required documents for corporate buyers:

- Original of the certificate of incorporation or trade license

- Original certificate of incorporation and articles of association

- Legal translation of the memorandum and articles of association

- Original incumbency certificate (not older than 3 months)

- Copy of the shareholders’ passports

- Original of the resolution approving the purchase

- Original POA

- Original passport of the authorized representative

FAQ

Below is an overview of the most frequently asked questions when it comes to buying an apartment in Dubai.

Do I get a VISA by buying an apartment?

Property buyers in Dubai receive a 2-year residence permit, which can be renewed. The minimum investment for a permit is AED 1 million and the property must be in a condominium. The permit also allows the support of family members, including personal staff and domestic servants. Property owners should not reside outside the UAE for more than 6 consecutive months for the permit to remain valid.

We will be happy to support you in obtaining a so-called Golden VISA.

What is the average price of an apartment?

First of all, you need to be clear about your financial situation. Whether you have savings you can rely on or you want to apply for a mortgage, you should find out the maximum amount you can spend on a property without burdening yourself. Try to find out the approximate amount you can qualify for a home loan before you start looking, so you can shop around for properties you know you can afford. The average price for a property in Dubai is between AED 300,000 and AED 350,000. Even under 300,000, you can probably buy an International City Studio that is closer to AED260,000-270,000. USD 100,000 is the average starting price in Dubai.

Buying a Dubai apartment as a German - is it possible?

Buying an apartment in Dubai as a German is absolutely possible. There are even numerous local banks in Dubai that can provide financing of up to 60%. As long as you have the necessary financial means or income, buying an apartment in Dubai is possible, as is local financing.

Experience

Summary

Dubai is an extremely interesting location for both private and commercial real estate investors, and the returns and earnings potential are far above the European average. If you know and consider the basic aspects (property developer, condition, fees…), buying an apartment in Dubai is definitely a sensible investment.

We are happy to support you throughout the entire process. Simply arrange a non-binding initial consultation to get to know us in advance and answer any questions you may have.