The UAE is one of the most attractive locations for entrepreneurs from all over the world and also offers a high quality of life, making it a popular country for expatriates.

Opening a company in Dubai is for many the easiest way to get a VISA for emigration and significantly reduce their tax burden. In this comprehensive guide, you will learn everything you need to know about setting up a company in Dubai, from requirements and procedures to costs and ongoing compliance.

Why Dubai? Advantages at a glance

Dubai is not only a place of extremes, but also a serious global economic player. The city combines modern infrastructure, economic stability and an advantageous geographical location. Here are some reasons why Dubai is particularly attractive for entrepreneurs:

1st position

Dubai acts as a bridge between the emerging markets of the East and the established markets of the West. This strategic location makes it an important logistics and trade center.

2. economic stability

Dubai has proven to be resilient to global economic fluctuations thanks to its impressive economic stability and the diversification of its economic sectors. Swift political decisions promise innovation and legal certainty for long-term business decisions.

3. tax advantages

The UAE and Dubai offer extremely attractive tax benefits for companies and entrepreneurs. tax advantages.

In principle, no taxes are payable on salaries, dividends, capital gains (including crypto gains) and rental income at a private level. As a private individual, you are therefore largely tax-exempt.

The company itself in Dubai generally pays no tax up to AED 3,000,000 turnover (€750,000), as there is still the Small Business Relief. Companies above this amount pay 9% corporation tax on company profits. However, there is still an allowance of around 3750,000 (just under €100,000), which does not have to be taxed. Combined with a salary, several hundred thousand euros can be paid out tax-free.

Banking environment

Dubai and the UAE offer a great banking environment, which is not the case in every tax-free country is the case. The major banks are partly government-backed and offer stable, secure and convenient banking, both privately and for businesses. Banks in Dubai such as FAB, Mashreq or ADCB are highly recommended.

Due to the tax advantages, fast incorporation and good infrastructure, companies in Dubai are definitely one of the most sought-after setups in the field of offshore companies.

Prerequisites

In principle, there are no legal requirements for setting up a company in Dubai. Most licenses are free, i.e. unregulated. Only some licenses for specialized activities (doctors, lawyers, pilots, etc…) require a license release from the authorities. More on this later.

Otherwise, anyone who does not have at least a serious legal history in the UAE can set up a company in Dubai.

Fundamentals

In general, there are a few things you need to understand before you can start a business in Dubai. Let’s take a look at the individual points.

Company location

Before you settle down, you need to decide whether you want to work in a free zone, mainland or offshore. Depending on your requirements, both options have their own advantages and special features.

Freezone (FZCO)

If you want your business to be 100% owned, you can apply for a license and a location in one of Dubai’s free zones. The concept of free zones was introduced by the Dubai government to attract foreign interest in setting up businesses in the city. Essentially, it is a special economic zone where entrepreneurs can enjoy full ownership rights, a corporate tax of 9% (for UAE companies with profits of AED 375,000 or more) and a personal income tax of 0%.

However, one of the main restrictions when operating a business in a free zone is that you are not allowed to trade directly with the local UAE market.

There are currently over 30 free zones in Dubai. As a rule, each free zone focuses on a specific industry and offers licenses to companies within these categories. Here are some examples:

- Dubai Silicon Oasis (DSO)

- Dubai International Finance Center (DIFC)

- Dubai Internet City (DIC)

Mainland (LLC)

The LLC is one of the most common legal forms and offers a balanced mix of flexibility and limited liability. This option is particularly suitable for small and medium-sized companies that do business in Dubai (mainly selling products) and also have customers here.

Mainland companies generally enjoy a higher reputation, get bank accounts more easily and are allowed to do business anywhere (geographically). There are also more licenses for Freezone companies.

Offshore

Offshore companies can also be registered in a free zone and enjoy many of the same benefits. However, it is not a substitute for a company in a free zone. The main difference between a company in a free zone and an offshore company is business operations. Offshore companies are allowed to do business outside the UAE and not inside. They are also not required to deposit a minimum amount of capital prior to incorporation.

In contrast to a company in a free zone, however, a sponsor is required who limits your foreign shareholding to 49%.

Licenses and activities

In addition to deciding on an area, you will also need to determine the type of license you need. The Department of Economic Development (DED) is responsible for issuing licenses and there are 3 main types you can apply for:

Commercial License

To start a business in Dubai that involves trading activities or the buying and selling of goods, you need a trading license. This license can apply to businesses in the areas of import and export, sales, logistics, travel and tourism, general business and real estate.

Industrial License

This type of license is issued to companies that convert natural materials and resources into end products – manually or mechanically. This license applies to companies such as textile, metal and paper manufacturers.

Professional License

The trade license is issued to companies that operate as service providers, craftsmen or artisans. Examples of businesses that apply for this type of license are medical services, beauty salons and repair services.

Setting up a company in Dubai – procedure

When setting up a business, free zones are particularly popular with foreign entrepreneurs, and for good reason – they offer 0% personal tax, low corporate tax rates, 100% business ownership, 100% repatriation of capital and profits and no currency restrictions.

That’s why we’ll go into the process of setting up a company in a free zone here.

Here are the 7 steps you need to take to start your business in a free zone:

1. determine business activity

The first step to starting your business and obtaining a license is to determine the type of business you want to start. Whether you want to start a small business in Dubai or a crypto business in the UAE, there are over 2,100 business activities to choose from, all of which fall into different groups from the industrial, commercial, trade and tourism sectors. You can find the full list on the DED website.

2. selection of the free zone

As mentioned above, there are over 30 free zones to choose from in Dubai. The nature of your business can influence which free zone you choose to settle in. As a rule, it makes sense to set up near companies in the same industry.

3. choose a company name

When choosing your company name, it is important that it complies with the UAE’s strict naming conventions. Names that contain offensive language, could be perceived as religiously offensive or refer to political groups or the mafia are prohibited. If you name your business after a person, you must prove that this person is a partner or owner of the business (initials or abbreviations are not allowed).

Naming your business can be a complicated process. You can save time and effort by consulting an expert to help you comply with conventions and get your name approved.

4. foundation

The company is then founded. All the necessary information must be submitted to the relevant free trade zone. Below is an overview of the most important ones:

- Company name

- Licenses

- Corporate structure

- Passport

- Proof of insurance

Once these data and documents have been submitted, confirmation by the authorities and official registration usually takes a week.

5. entry visa

Once you have founded the company, you are (usually) employed as a managing director, known here as a general manager. This employment entitles you to an entry visa via Employment. This is absolutely necessary if you want to enter the UAE. A tourist visa is not sufficient for the following step. The visa via Employment is usually issued within one week of application.

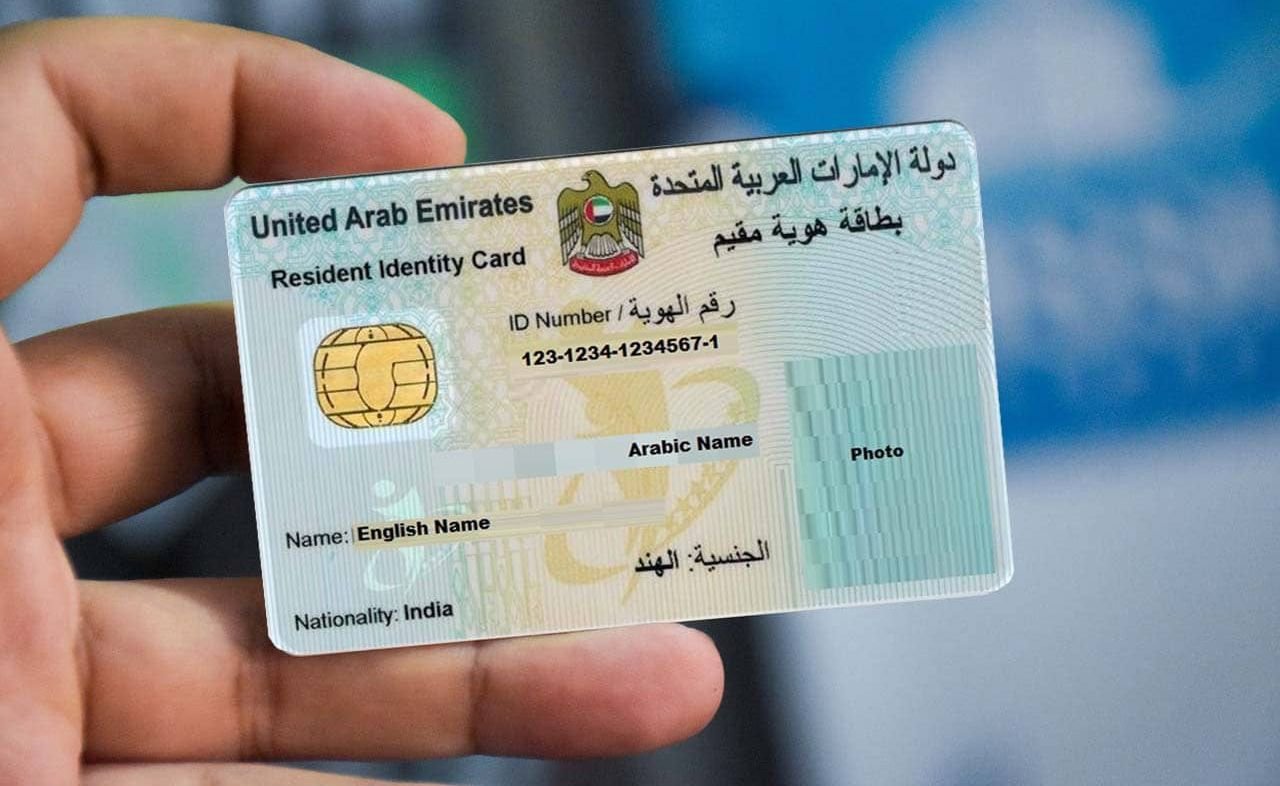

6.Emirates ID

The next crucial step is to apply for the Emirates IDthe key document to be fully authorized to do business in the UAE. The EID is an identification document that enables all economic activities in the UAE. This includes above all

- Opening an account (private and business)

- Renting / buying real estate

- Telephone and Internet contract

- and much more.

With the Emirates ID, you also receive a document which is also the visa for your stay in Dubai. There are different types with normal employment, the visa in Dubai but 2 years.

How do I get the Emirates ID?

The following steps are necessary to obtain an Emirates ID:

- Entry via Employment VISA

- Medical test

- Application for EID at the local authority

- Biometrics

After a few days you will receive the EID by post.

7. bank account

As soon as the company is established and you have the Emirates ID, you can open a open a bank account in Dubai. There is a wide range of local and international banks to choose from. There are also FinTechs, which are interesting for smaller companies.

8. ongoing management

From 2023, companies in Dubai will be required to register with the tax system on an ongoing basis. This also means keeping accounts and potentially paying taxes. Above the USD 100,000 profit threshold, 9% corporate tax is payable.

Costs

The costs for the entire setup vary greatly and depend on the factors mentioned above, such as licenses, free zone and company structure. In general, however, it can be said that setting up a company in Dubai with professional implementation and support usually costs €8,000 – €10,000. The annual costs then amount to around €5,000 for a company with a visa.

The more VISAs the company holds or sponsors, the more expensive they are to set up and renew each year. As a rule, the company incurs additional costs of around €1,000 per VISA per year.

Summary

Setting up a company in Dubai, just like in Germany, Austria and Switzerland, is a process that should be carefully considered. However, if you have a clear goal, know what you want and have a professional contact person on site to handle the process, it only takes a few days. For a non-binding initial consultation on company formation in Dubai you are welcome to contact us.